Origins & Strategic Pivot (1958-1990s)

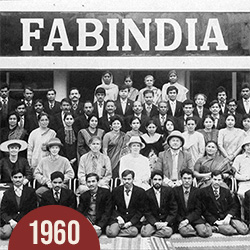

- Founded by an American Entrepreneur: John Bissell, an American, started FabIndia in 1958, not as an apparel brand, but as an exporter of home furnishings.

- Craftsmanship as a Differentiator: The brand was built on the foundation of working directly with artisans and weavers to export handcrafted goods.

- Transition to Retail (1990s): After John’s passing, his son William Bissell saw an opportunity to transform FabIndia from an exporter to a domestic retail giant.

- Strategic Bet on Ethnic Wear: Despite India’s increasing Westernization post-liberalization, FabIndia doubled down on ethnic wear, targeting a niche yet highly loyal customer base.

Retail Expansion: A Customer-Centric Approach

FabIndia understood the intricacies of the Indian apparel market, which is:

- Highly price-sensitive

- Largely unorganized (60%)

- Trust-driven (touch-and-feel preference for fabric quality)

Retail Strategy Breakdown

FabIndia focused on:

- Exclusive Brand Outlets (EBOs):

- Unlike competitors who leverage multi-brand retail, FabIndia has aggressively expanded its EBOs, accounting for 80% of total revenue.

- The brand’s fourth-largest EBO network in India after Manyavar, Biba, and W.

- Experience Stores: Larger outlets (8,000-12,000 sq. ft.) offering apparel customization, kids’ play zones, FabCafe, and design studios.

- Company-Owned, Company-Operated (COCO) Model:

- Unlike brands like Manyavar, which follow an asset-light franchise model, FabIndia prioritizes owning and operating its stores to maintain brand integrity and customer experience.

- Despite shifting towards franchise operations for diversification, twice as many stores remain company-owned compared to franchise stores.

- Localization & Personalization:

- Store layouts emphasize cultural storytelling and the heritage of handcrafted textiles, reinforcing brand loyalty.

Cracking Supply Chain Challenges & Artisan Trust

FabIndia’s core mission revolves around empowering artisans. This strategy has provided them with a sustainable, high-quality supply chain, giving them a competitive edge.

The FabIndia Supply Chain: A Decentralized Yet Scalable Model

- 50,000+ artisans from 21 states & 12,000 farmers from 5 states contribute to FabIndia’s supply chain.

- The brand operates through 900 third-party contractors, enabling it to manage dispersed artisanal clusters efficiently.

- India produces 95% of the world’s handwoven fabric, making FabIndia’s role in sustaining this sector crucial.

Craft Cluster Development Initiatives

To preserve and scale traditional craftsmanship:

- ₹50 crore investment in the Craft Cluster Development & Livelihood Impact Program.

- Skill development, financial literacy training, and integration of artisans into the supply chain.

- Government collaborations for handicraft certifications to authenticate genuine handmade products.

Social & Economic Impact

- 30% decline in artisan numbers over 30 years—FabIndia’s interventions are reversing this trend.

- 50% of artisans are women, contributing to women’s financial empowerment and improved household incomes.

SKU Diversification & Brand Extensions

FabIndia evolved from a pure-play apparel brand to a full-fledged lifestyle brand.

Timeline of Diversification

| Year | Category Introduced |

|---|---|

| 1982-84 | Clothing |

| 2000 | Home Décor (non-textile) |

| 2004 | Organic Food |

| 2006 | Personal Care |

| 2008 | Handcrafted Jewelry |

| 2024 | Dining & Home Design |

Strategic Brand Segmentation

- Fab Essentials (Personal Care)

- Organic India (Organic Food – acquired in 2013, now being sold to Tata Group)

- Fab Cafe (Dining Experience)

Why This Strategy Works

- Brand perception control: Separate branding prevents customers from associating FabIndia solely with apparel.

- Lifestyle positioning: Enables FabIndia to cater to a broader audience while maintaining its premium appeal.

Conclusion: The Future of FabIndia

FabIndia’s ability to blend heritage with modern retail strategies has cemented its position as a Tata-equivalent in India’s fashion industry. With continued expansion into experience-driven retail, sustainable supply chains, and strategic diversification, the company remains a formidable force in India’s ₹1,50,000 crore apparel market.

Key Takeaways for Business Strategy:

- Niche Dominance Over Mass Market – Instead of competing in a commoditized Western apparel market, FabIndia captured a dominant share in a smaller but high-loyalty ethnic wear segment.

- Customer-Centric Retail Model – Prioritizing company-owned experience stores over multi-brand outlets ensured consistent brand perception and customer trust.

- Sustainable & Inclusive Supply Chains – Investing in artisan clusters not only secured exclusive product access but also strengthened social impact credentials.

- Strategic SKU Expansion – Transforming into a lifestyle brand rather than remaining a pure apparel player helped broaden revenue streams.

FabIndia’s story exemplifies how businesses can scale while preserving cultural heritage and social responsibility, making it a powerful case study in sustainable business growth.

Reference

GrowthX Wireframe – “How Fab India DISRUPTED India’s ₹1,50,000 Crore Apparel Market.” YouTube Video.

Leave a Reply