Introduction: Apple’s Strategic Shift

Apple, the world’s most valuable company, has made a significant bet on India by deciding to manufacture the latest iPhone 16 Pro series in the country. This move is a part of Apple’s larger strategy to reduce its dependence on China while tapping into India’s growing economy.

With India now producing 14% of the world’s iPhones, Apple is clearly signaling its long-term commitment to the region. The question is, why is Apple so bullish on India—a country that contributes only 2% to its total revenue? More importantly, can India position itself as the next big global manufacturing hub?

This case study will break down Apple’s manufacturing strategy, the China-plus-one shift, India’s advantages and challenges, and what this means for India’s economic growth.

1. The Critical Role of iPhones in Apple’s Business Model

To understand Apple’s manufacturing decisions, it’s crucial to acknowledge the significance of iPhones in its revenue stream. For the last three years, iPhones have contributed over 50% of Apple’s total revenue, generating approximately $200 billion annually—comparable to the total market capitalization of Reliance Industries.

With such a heavy reliance on iPhones, Apple must make calculated moves on where it manufactures them to optimize costs, efficiency, and supply chain resilience.

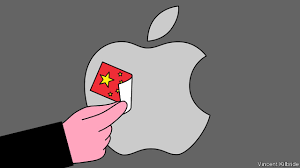

2. Apple’s Existing Supply Chain and Manufacturing Dependence on China

Apple’s supply chain is divided into two key segments:

- Component Manufacturing – Apple sources components (such as screens, cameras, and modems) from global suppliers:

- Displays from Samsung (South Korea)

- Cameras from Sony (Japan)

- Modems from Qualcomm (U.S.)

- Semiconductor chips from TSMC (Taiwan)

- Batteries from TDK and Cowell (China)

- Contract Manufacturing & Assembly – Apple does not manufacture iPhones in-house but outsources assembly to contract manufacturers:

- Foxconn, Pegatron, and Wistron (Taiwan)

- Luxshare and Wingtech (China)

The problem? 87% of Apple’s suppliers have manufacturing facilities in China, making the company heavily reliant on a single region. The biggest iPhone manufacturing hub, Foxconn’s plant in Zhengzhou, China (also called “iPhone City”), produces 500,000 iPhones daily.

This overdependence on China exposes Apple to geopolitical risks, economic fluctuations, and supply chain disruptions—leading to its China-plus-one strategy.

3. The Strategic Shift: Why Apple Is Moving to India

A. Rising Demand for iPhones in India

India is expected to become the third-largest market for iPhones, with consumer trends shifting towards premiumization and higher per capita income. Apple’s recent store openings in Mumbai (BKC) and Delhi saw massive footfalls, reflecting a growing demand for iPhones.

At the same time, China’s smartphone market is stagnating, and Apple has lost ground to competitors like Huawei, Vivo, and Oppo. This makes India an attractive alternative growth market.

B. Geopolitical and Trade War Pressures

- U.S.-China tensions have led to higher tariffs on imports between the two countries, increasing costs for Apple.

- The COVID-19 pandemic exposed the risks of relying on China when lockdowns led to worker protests and disrupted iPhone production.

- With Donald Trump likely returning to power in 2024, the trade war could intensify, pushing Apple to further diversify its supply chain.

C. India’s Manufacturing Push: The China-Plus-One Narrative

India aims to become the next global manufacturing hub by:

- Boosting Exports – Strengthening India’s economy through higher exports of electronics.

- Increasing Foreign Direct Investment (FDI) – Attracting global companies like Apple to set up plants and bring new technologies.

- Generating Employment – With unemployment at 10%, large-scale manufacturing can create millions of jobs.

- Enhancing Technological Capability – Manufacturing high-tech products like iPhones upskills the workforce.

D. Government Initiatives to Support Manufacturing

India’s government has launched multiple policies to attract manufacturers, including:

- Make in India – Encourages local manufacturing by reducing reliance on imports.

- Production-Linked Incentive (PLI) Scheme – Offers subsidies and tax benefits to companies investing in manufacturing.

- Skill India Initiative – Aims to train workers in advanced manufacturing.

As a result, 99% of all smartphones sold in India are now assembled locally. Major contract manufacturers Foxconn, Pegatron, and Wistron have already set up assembly plants, making India the second-largest iPhone assembler after China.

4. India vs. Vietnam: The Competition for the Next Manufacturing Hub

While India is making strides, Vietnam is a serious competitor in the China-plus-one race. Here’s how Vietnam compares:

| Factor | Vietnam | India |

|---|---|---|

| Mobile Phone Exports (2023) | $25 Billion | $15 Billion |

| Apple’s Manufacturing Plans | 20% of iPads, 5% of MacBooks, 65% of AirPods | 25% of iPhones by 2025 |

| Samsung’s Manufacturing Share | 60% of Samsung’s global production | Low Samsung presence |

| Import Duties | Low, due to free trade agreements | High, making imports expensive |

| Component Manufacturing | Strong ecosystem | Still in early stages |

| Land & Regulatory Policies | Simplified (one-party rule) | Complex (state vs. center policies) |

| Infrastructure | Better ports, roads | Still improving |

While Vietnam has a stronger existing ecosystem, India has a larger consumer market, a growing workforce, and government incentives that make it a promising long-term bet.

5. The Road Ahead: India’s Challenges and Future Growth

While Apple’s expansion in India is a strong signal of confidence, there are key challenges that India must address to fully capitalize on this opportunity:

- High Import Duties on Components – Apple still imports displays, chips, and modems, making India less cost-competitive than Vietnam.

- Lack of Component Suppliers – Unlike Vietnam, India still lacks a robust component manufacturing ecosystem.

- Regulatory Challenges – India’s complex land acquisition laws and state-vs-center conflicts slow down expansion.

- Infrastructure Gaps – Roads, ports, and supply chain networks need further development.

However, Tata Group is stepping in to develop India’s first local iPhone component manufacturing unit, marking a major step toward supply chain independence.

Conclusion: Will India Become the Next China?

Apple’s decision to manufacture iPhones in India signals a fundamental shift in global supply chains. With 14% of iPhones now made in India, this number is expected to rise to 25% by 2025 and 50% in the future.

While India has challenges, its booming economy, young workforce, and supportive policies make it an ideal destination for global manufacturers. The next decade will be crucial as India competes with Vietnam and other nations to establish itself as the next major electronics manufacturing hub.

For India to fully capitalize on this opportunity, policymakers must streamline regulations, improve infrastructure, and boost local component manufacturing. If executed well, India could transform into the next global factory—giving China serious competition.

Leave a Reply