Introduction

Blue Tokai, a homegrown coffee brand, has emerged as a disruptor in India’s ₹4,000 crore coffee industry. With a valuation of ₹650 crore and annual revenue exceeding ₹130 crore, the brand has pioneered specialty coffee in a market traditionally dominated by instant coffee and large cafe chains. This case study delves into Blue Tokai’s strategic playbook, its key market insights, and the expansion framework that has fueled its success.

The Evolution of Coffee Consumption in India

Understanding the Three Waves of Coffee

- First Wave (1800s – Early 1900s): Coffee was commoditized, with little emphasis on branding or quality.

- Second Wave (Late 1900s – Early 2000s): The rise of Starbucks and other premium cafes introduced experience-driven coffee culture.

- Third Wave (2000s – Present): Consumers started demanding high-quality, traceable coffee with a focus on bean origin, roasting, and brewing methods.

India lagged behind in adopting the third wave and was still heavily influenced by the second wave when Blue Tokai entered the market in 2011.

Market Analysis

Consumer Coffee Segments in India

- Home Consumption

- Dominated by instant coffee brands such as Bru and Nescafé, which still control over 70% of this market.

- Cafes & Out-of-Home Consumption

- Led by Cafe Coffee Day (CCD), which once held 50% market share with over 1,200 outlets.

- Starbucks’ entry in 2012 in partnership with Tata revolutionized the premium coffee experience.

Despite the dominance of these players, specialty coffee was largely absent from the Indian market. This gap was the key opportunity that Blue Tokai identified.

The Blue Tokai Strategy: 3 Key Growth Insights

1. Product Depth & Quality Control

- Blue Tokai focused exclusively on 100% pure Arabica beans, known for their superior flavor profile.

- They pioneered freshly roasted beans delivered to customers’ doorsteps, ensuring high quality.

- To ensure peak freshness, they introduced a four-week freshness rule: roasting only after an order was placed.

- Built direct relationships with farmers in Karnataka, Kerala, and Tamil Nadu (which contribute over 96% of India’s coffee production).

- Created a transparent sourcing model, offering higher prices to farmers and featuring their estate names on packaging.

Competitive Edge: Unlike mass coffee brands, which focus on cost-efficiency, Blue Tokai prioritized flavor, freshness, and traceability.

2. Customer-Centric Relationships & Education

- Built deep trust with customers by emphasizing transparency in sourcing and roasting processes.

- Established educational content on brewing methods, bean origins, and roasting styles, turning casual drinkers into specialty coffee loyalists.

- Tackled the barrier of brewing complexity by promoting traditional Chai Channi brewing instead of expensive coffee equipment.

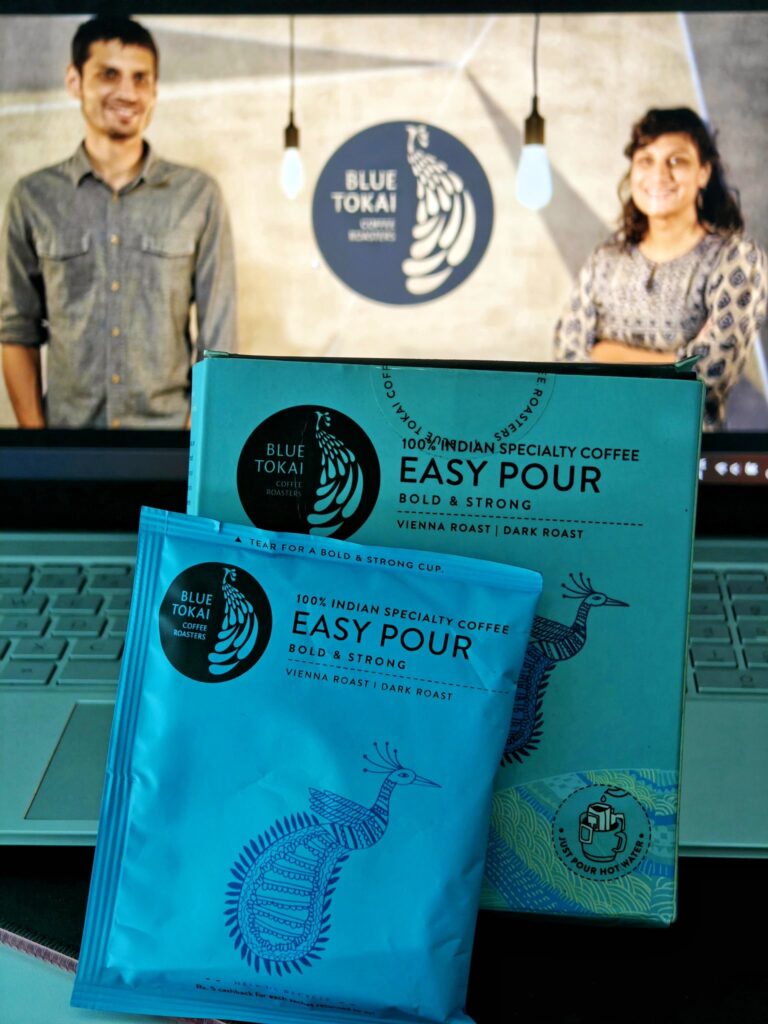

- Introduced Easy Pour Coffee sachets, allowing instant specialty coffee consumption.

Competitive Edge: Blue Tokai’s educational and relationship-building approach cultivated high customer engagement and loyalty, fostering a cult-like following.

3. Smart Expansion Model

- Selective presence in Tier-1 cities, ensuring premium positioning instead of mass-market penetration.

- Adopted an Omni-Channel Strategy:

- Retail Stores & Cafes: Not just a revenue stream but a branding tool, ensuring high recall.

- Direct-to-Consumer (D2C) Model: Website sales drove brand engagement and direct customer relationships.

- B2B Expansion: Partnered with corporates to supply premium office coffee solutions, contributing 50% of revenue.

- Plans to expand 80 new stores annually, focusing on top urban markets rather than oversaturating lower-tier cities.

Competitive Edge: Unlike traditional cafe chains, Blue Tokai leveraged a multi-channel model, ensuring customer acquisition, retention, and scale efficiency.

Key Takeaways for Business Leaders

- Identify Market Gaps: Blue Tokai recognized the absence of specialty coffee in India and capitalized on it.

- Customer Education as a Growth Lever: By simplifying specialty coffee consumption, they removed major adoption barriers.

- Sustainable Sourcing Builds Competitive Moats: Strong supplier relationships ensure superior quality and long-term cost advantages.

- Omni-Channel Strategy Ensures Scalability: A mix of D2C, retail, and B2B partnerships balances customer reach and revenue streams.

Conclusion

From a small home-based roasting setup in Delhi to a ₹650 crore brand, Blue Tokai has successfully disrupted India’s coffee industry. Their relentless focus on product quality, customer education, and strategic expansion has cemented them as the leader in India’s specialty coffee space. As they expand aggressively into Tier-1 cities and scale their B2B footprint, they are well-positioned to shape the future of coffee consumption in India.

Leave a Reply