Introduction

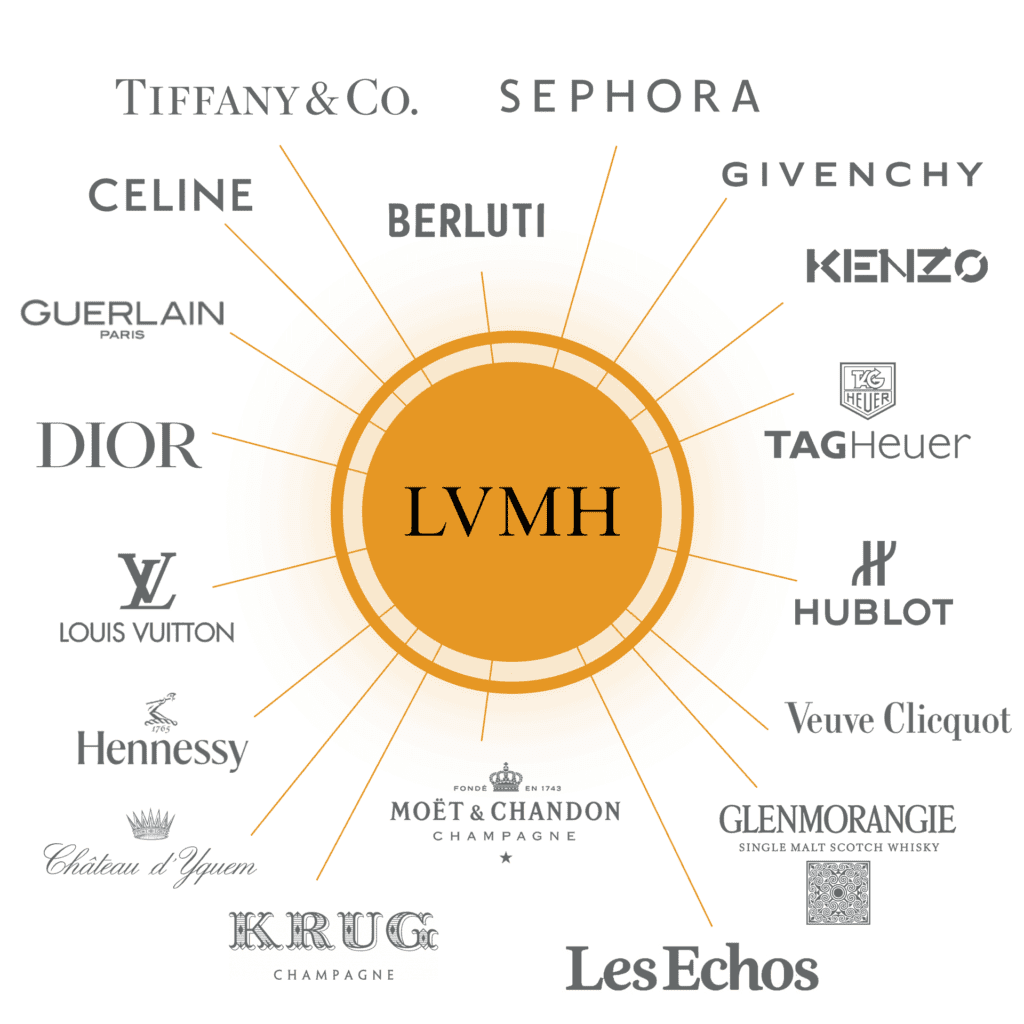

Luxury conglomerate LVMH (Louis Vuitton Moët Hennessy) has grown into a $500 billion empire, encompassing 75 brands (or “Maisons”) across multiple sectors. Led by Bernard Arnault, the company dominates the luxury market with an aggressive acquisition strategy, exclusive branding, and an unwavering commitment to craftsmanship. This case study explores the key strategic moves that have made LVMH the most valuable luxury brand conglomerate in the world.

Business Strategy: The Pillars of LVMH’s Success

1. Brand Management & Exclusivity

LVMH maintains a delicate balance between exclusivity and mass appeal. The company ensures that its brands remain aspirational by:

- Storytelling & Emotional Appeal: Customers don’t just buy luxury goods; they buy into an experience, a legacy, and an aspirational lifestyle.

- Controlled Distribution: LVMH brands restrict product availability to maintain exclusivity.

- Pricing Strategy: The company has implemented moderate price increases (5-7%), unlike competitors such as Chanel, which doubled prices post-pandemic.

2. Acquisitions & Market Consolidation

LVMH’s success is largely attributed to its aggressive acquisition strategy:

- Bulgari (2011)

- Dior (2017) – $13 billion

- Rimowa (2016) – 80% stake

- Tiffany & Co. (2021) – $15.8 billion

Each acquisition is not just a purchase but a transformation. For example, after acquiring Tiffany, LVMH doubled its profits to over $1 billion annually, proving its unparalleled ability to revitalize historic brands.

3. Leadership & Governance

Bernard Arnault, the world’s richest man, has built LVMH into a family-run empire, with all five of his children holding key management roles. His leadership style is characterized by:

- A focus on long-term brand desirability.

- Decentralized Management: Retaining original creative teams and allowing them autonomy.

- A ruthless yet strategic negotiation approach, as seen in the Tiffany deal.

4. Vertical Integration & Retail Expansion

Unlike other conglomerates, LVMH controls its supply chain end-to-end, from manufacturing to retail. The brick-and-mortar store experience remains critical, with stores positioned as “luxury temples”, creating immersive experiences that reinforce brand loyalty.

Financial Growth & Market Performance

- 2022 Revenue: $86.3 billion (up 23% from 2021).

- Q1 2023 Revenue: $22.9 billion (up 17% YoY).

- Stock Price (May 2023): $191.99.

- Store Count (1999-2022): 5X increase, now across 81 countries.

- Employee Base: 196,000+ worldwide.

This impressive growth reflects LVMH’s ability to withstand economic downturns and expand even in challenging times.

Marketing & Consumer Engagement

1. Youth & Pop Culture Integration

Luxury is driven by youth culture and trends. LVMH has mastered this by:

- Collaborating with streetwear brands (e.g., Louis Vuitton x Supreme).

- Hiring innovative designers, like the late Virgil Abloh, who introduced a younger audience to Louis Vuitton.

- Leveraging celebrity endorsements and social media to maintain brand relevance.

2. The Shift Toward Digital & E-Commerce

Post-pandemic, luxury brands saw a boom in e-commerce, but LVMH ensures a “rebalancing” towards in-store shopping. Online channels complement physical stores rather than replace them.

3. Counterfeit Prevention: Blockchain & RFID

With the $500 billion counterfeit luxury market growing, LVMH co-developed Aura Blockchain Consortium, an RFID-based authentication system, to protect brand integrity.

Challenges & Future Outlook

1. Market Sensitivity to Economic & Political Changes

- In 2021, China’s socialist policies wiped out $120 billion from the luxury sector.

- Asia’s revenue dropped by 5% in 2022 but rebounded in Q1 2023 (+14%).

2. Staying Exclusive While Expanding

- As LVMH grows, maintaining exclusivity while appealing to a wider audience remains a challenge.

3. Sustainability & The Rise of Resale

- LVMH is tackling sustainability with initiatives like apprenticeship programs for artisans.

- The luxury resale market (e.g., The RealReal, Fashionphile) is booming, requiring brands to adapt without diluting exclusivity.

4. Diversification: Expanding into Luxury Experiences

- LVMH Hotels & Hospitality: Expansion into Belmond (2019) and Cheval Blanc Maisons reflects a shift towards experiential luxury.

- Cruise & Travel Retail: LVMH-owned Starboard Cruise Services is seeing post-pandemic recovery.

Conclusion: LVMH’s Legacy & Future Growth

LVMH is more than just a luxury conglomerate; it is a cultural force that shapes global trends. Its long-term focus on brand desirability, aggressive acquisitions, vertical integration, and digital innovation ensures continued dominance in the luxury sector.

As competitors attempt to mimic its model, LVMH remains unrivaled—a testament to the genius of Bernard Arnault and the company’s unwavering commitment to heritage, exclusivity, and strategic growth.

Leave a Reply